What is factoring?

Factoring is a financing method in which a company sells its outstanding invoices to a third party, also known as accounts receivable financing. This gives your company the opportunity to get money quickly for invoices that have not yet been paid. Instead of waiting for payment terms from customers, factoring allows you to receive your money immediately – usually within 24 hours.

Why is factoring interesting for entrepreneurs?

More and more non-bank financing is being provided. Factoring is one of the fastest growing forms of alternative financing. For example, the financing monitor found that the volume of factoring had risen again in 2021 after a short-lived dip during the corona crisis. But what is factoring, how exactly does it work and why should you use it as an entrepreneur?

Factoring meaning

Factoring is an alternative financial service that helps entrepreneurs improve their cash flow by immediately paying out outstanding invoices. In short, it means that you sell your outstanding invoices to an external party, a factoring company. This gives you quick access to your money, without having to wait for payment from your customers.

In addition, the factor takes the risk of non-payment (this is also known as non-recourse factoring). Research shows that more than a quarter of companies pay their bills late. Difficult, if you have a fast growing company. Factoring means that you no longer have to wait to get your money. You have direct access to your money and can go full throttle ahead with business!

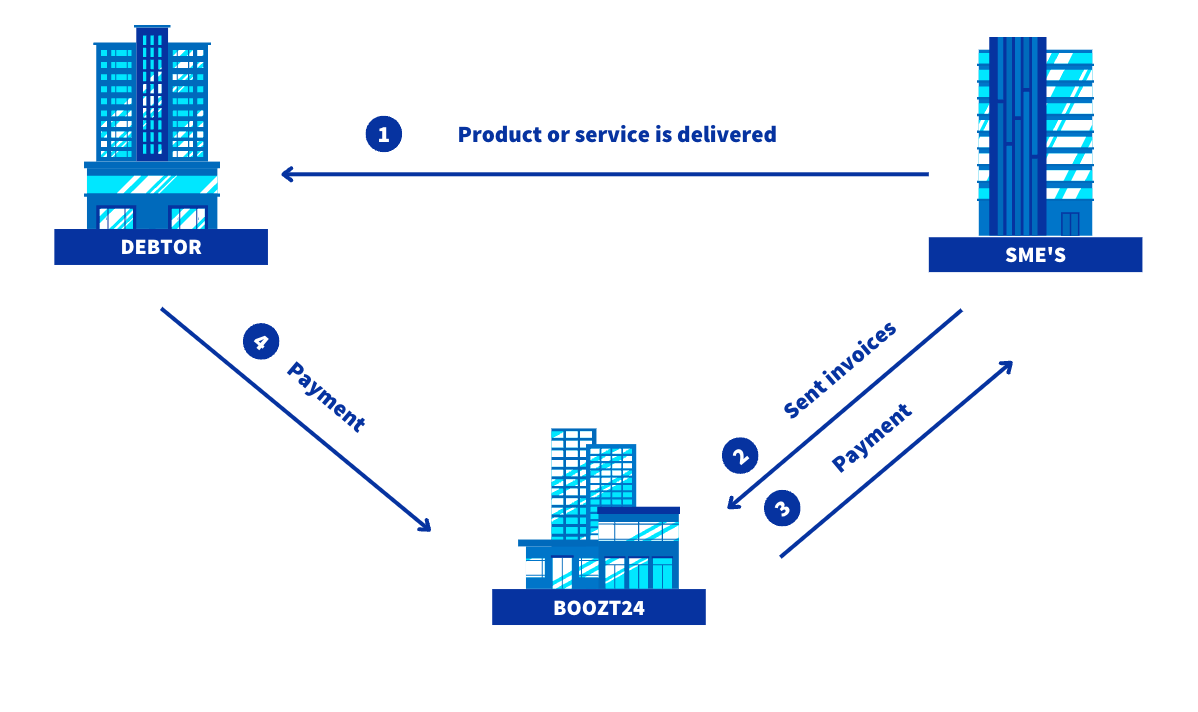

How does factoring work?

The factoring process differs per factoring company, each factoring company has its own process and rules. At Boozt24 factoring works as follows:

Step 1

Deliver product or service to the customer

Step 2

Send your invoice to the customer and to us

Step 3

We transfer 85% of the invoice amount to your account within 24 hours.

Step 4

Your customer pays Boozt24

Step 5

We transfer the last part of your money to your account.

The advantages of factoring at a glance

There are many benefits to factoring. We have listed the most important ones.

Factoring gives you quick access to your money that you owe from customers. This way you immediately have extra working capital to accelerate your business growth. At Boozt24 you receive money for your invoices within 24 hours.

Factoring shortens the term in which you get your invoices paid. This gives you more financial room to invest in your company and you do not have to worry about any liquidity problems..

Factoring is not a loan and therefore does not create debt on your company's balance sheet.

Factoring can be adapted to the needs of your business, grows as you grow and can be used to complement other forms of financing.

The disadvantages of factoring

While factoring offers many benefits, there are also some drawbacks that are important to consider. Below you will find the main disadvantages of factoring:

A factoring company gains insight into your invoices. Therefore always choose a reliable partner! Boozt24 is a member of the FAAN, the trade association for factoring companies in the Netherlands.

Factoring involves costs, just like any other form of financing. It is therefore important to have a good insight into these costs. But it's also important to remember that these costs can keep you growing. Factoring offers the opportunity to continue to invest, which you may not be able to do if you do not have enough working capital. Boozt24 offers the possibility to factor at attractive rates and is one of the cheapest factoring companies.

Although some entrepreneurs see this as an advantage, not every entrepreneur wants his debtor management to be taken over by a factoring company. At Boozt24 we think it is important that our customers keep control over their own customers. That is why we do not take over the debtor management, unlike most other factoring companies.

Do you want more information or get acquainted?

Are you curious about what we have to offer, or do you just want to get in touch? Fill in your details and we will contact you as soon as possible!

*required field

This site is protected by reCAPTCHA and the Privacy Policy of Google, and Terms of Service apply.