How to navigate through the payment terms of large customers as an entrepreneur?

The financial settlement by large corporations is usually not only slow, often these companies have no idea of the consequences of their long payment terms for SME suppliers.

Large corporations are by no means always aware that SMEs can find themselves in acute financial need if the payment of a large invoice is delayed. As an SME, it is therefore wise to make clear agreements with the customer in advance.

Clear agreements from the start

The payment term you want of, for example, fourteen or thirty days will rarely be met if you work with large corporations. That in itself need not be a problem. Especially if you work with monthly invoices. Then you will only have to wait for your money in the first period. After that it comes in monthly. But no matter how you work, discuss with the customer prior to the assignment or project. Make your position known in that conversation. This does not mean that you have to present yourself as a small SME that cannot survive a month without money. That is an attitude that many entrepreneurs – rightly so – do not want to adopt.

Many large companies have special terms for SMEs

At the same time, it is good to clearly indicate that you employ staff who must be paid monthly, pay rent for your property, pay taxes and receive other bills for which the payment term does not leave room. That's not being pathetic, that's nothing more than just making your position known.

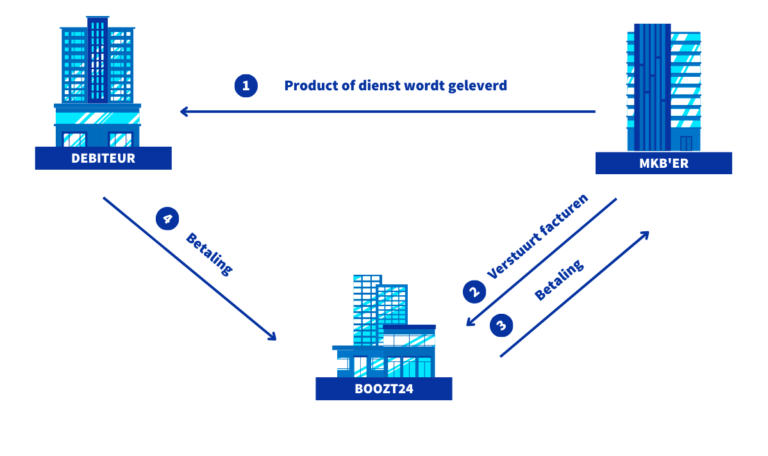

Moreover, you do not have to make any demands in return. If the customer works with a payment term of sixty or ninety days, you will have to accept that in general - although there are sometimes special arrangements for smaller SMEs (ask about this). However, now that the customer understands your position, you can clearly discuss the payment process. Ask explicitly to whom the invoice should be sent and what the payment process looks like.

Human errors

If a large customer has a long payment term, they must also adhere to this. Take yourself seriously. If the agreed payment term is not met, it is preferable to inquire by telephone in the first instance, which gives a more direct result than a reminder letter. Remain friendly and refrain from threatening language about collection agencies. Perhaps the payment is already in the pipeline or a mistake has been made. If there is no good explanation and/or you cannot make concrete agreements about payment, it is wise to send a formal payment reminder. In any case, always make sure that you immediately confirm all agreements you make in writing. Of course you don't want it, but if it comes to the point that a collection agency has to be called in, it is important to have a complete and correct file.

Fortunately, in practice most invoices are duly paid. Late payments are usually the result of busy periods, holidays, interim employees or human errors. Nothing to worry about - but of course that doesn't change the fact that you just need the money to pay your monthly bills.